More than 20mn UK households are facing a 54 per cent increase in energy bills from Friday and benefits will fall in real terms as economic data show surging inflation hit consumer spending even before the effects of Russia’s invasion of Ukraine were felt.

Energy bills for the 22mn households whose payments are capped will rise by an average of £693 to £1,971 a year from April 1 to reflect surging gas and oil prices.

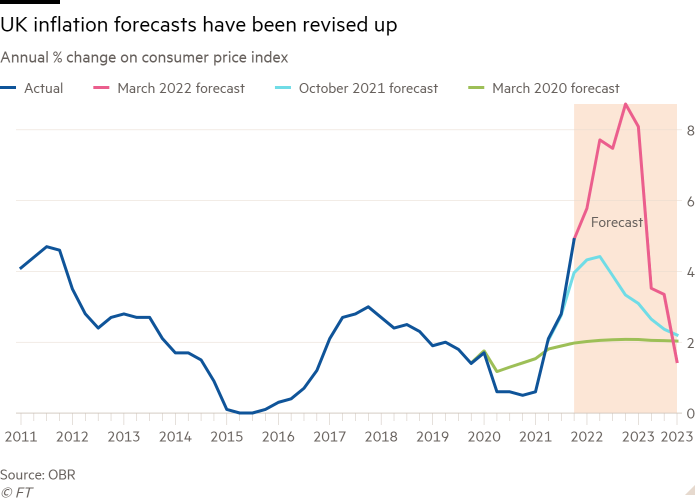

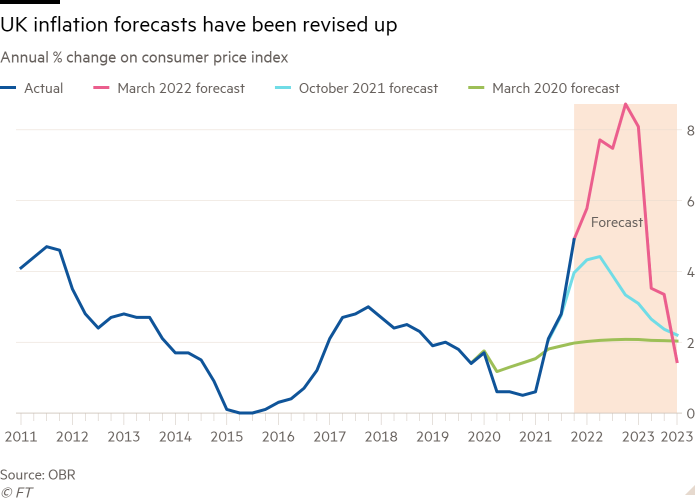

At the same time, universal credit, the main welfare payment, and the state pension are being increased by just 3.1 per cent. This is less than half the pace of inflation expected in the second quarter by the Office for Budget Responsibility, the independent fiscal watchdog.

The changes come as official data published on Thursday showed a fall in households’ real income, shrinking savings and lower growth in spending at the end of last year.

Surging prices will contribute to households’ real income falling this year at the fastest pace since records began in the 1950s, according to the OBR, as government support measures have offset only around a third of the fall in living standards.

Experts warned that surging costs will result in both fuel and absolute poverty rising. The Resolution Foundation, a think-tank, revealed on Friday that the number of English households in fuel stress will double from 2.5mn to 5mn as a result of the price cap increase.

The think-tank noted that another 2.5mn households are at risk of fuel poverty in October if the price cap rises again to £2,500, £300 less than the OBR forecast it could. National Energy Action, the leading fuel poverty charity, recently published similar figures.

Jonathan Marshall, senior economist at the Resolution Foundation, said the rise in energy bills “hastens the need for more immediate support” for households. He added that the government also needed a long-term strategy for improving home insulation, ramping up renewable and nuclear electricity generation, and reforming energy markets so that consumers’ bills are less dependent on global gas prices.

The Resolution Foundation also estimated that 1.3mn people will be pushed into absolute poverty next year as a result of the cost of living crisis, including 500,000 children.

Frances O’Grady, general secretary of the Trades Union Congress, representing the majority of unions, said the government’s Spring Statement last week was “woefully inadequate”, and called on chancellor Rishi Sunak to present an emergency Budget.

“People shouldn’t be struggling to cover the basics,” she said.

Energy bills are rising as the ONS revealed that in the last three months of 2021, real household disposable income fell by 0.1 per cent compared with the previous quarter while household expenditure rose only 0.5 per cent.

This was much less than previously estimated and a sharp slowdown from 2.6 per cent growth in the preceding three months, signalling that the momentum behind the consumer recovery had begun to falter at the end of last year.

This was despite gross domestic product growth being revised up thanks to strong activity in the health sector.

Falling real incomes mean that households bought more goods and services by reducing their savings to maintain the same standard of living. The household saving ratio, the average percentage of disposable income that is saved, decreased to 6.8 per cent in the last quarter of 2021, down from 7.5 per cent in the previous three months and the lowest since the start of the pandemic.

Commenting on the ONS data, Samuel Tombs, chief UK economist at consultancy Pantheon Macroeconomics, said that “no one should rule out a decline in households’ real expenditure this year that could drag the overall economy into a recession”.

Signs of belt-tightening have become evident in data covering the start of this year as inflation climbed to a 30-year high in February.

UK consumer confidence dropped to a 17-month low in March, real wages contracted in the three months to January and retail sales fell. To cope with rising prices, British consumers are cutting on non-essential spending and energy use, according to an ONS survey published this week. But for many, that is not enough and Citizens Advice, a charity, said it had referred a record number of people to food banks or other charitable support this month.

Businesses are also feeling the hit from lower demand and rising costs.

The British Chambers of Commerce, a business organisation, on Friday reported that a record proportion of businesses expected to raise prices in the next three months.

Suren Thiru, head of economics at the BCC, said: “Russia’s invasion of Ukraine has raised the risk of a renewed economic downturn by aggravating the financial squeeze on businesses and households and disrupting the supply of commodities to key sectors of the UK economy.”

Additional reporting from Nathalie Thomas

Credit: Source link