Even as the outlook darkens for the airline industry, Johan Lundgren has decided it is time to be more ambitious. The easyJet boss is switching to a bolder strategy to take on freewheeling rivals Ryanair and Wizz after his notably cautious approach to the pandemic.

The UK low-cost carrier is buying up slots at busy airports, including London Gatwick, and predicting a return to close to pre-pandemic levels of flying by next summer in a significant about-turn.

Lundgren hopes the change will shore up easyJet’s battered share price and satisfy some “underwhelmed” investors, who have been calling for a more aggressive strategy.

It shows that the Swedish executive, who has emphasised being “credible and trustworthy”, is hoping to step up his challenge to Ryanair and Wizz, Europe’s two other big, low-cost carriers.

“In times of uncertainty, there will always be a space for big mouths who fill the vacuum with endless expectations of growth in the long term. And that is attractive, perhaps, for some people to listen to,” he told the Financial Times as he took a swipe at Ryanair boss Michael O’Leary and Wizz’s József Váradi, who have both been bullish in their predictions for growth.

Lundgren’s new approach, bolstered by easyJet’s bigger-than-expected £1.2bn capital raise in September, comes at a key moment for the airline as uncertainty sweeps though the industry after the emergence of the Omicron coronavirus variant last week.

He was speaking before the UK government announced new travel restriction on Saturday evening, in a blow to the aviation industry’s recovery hopes.

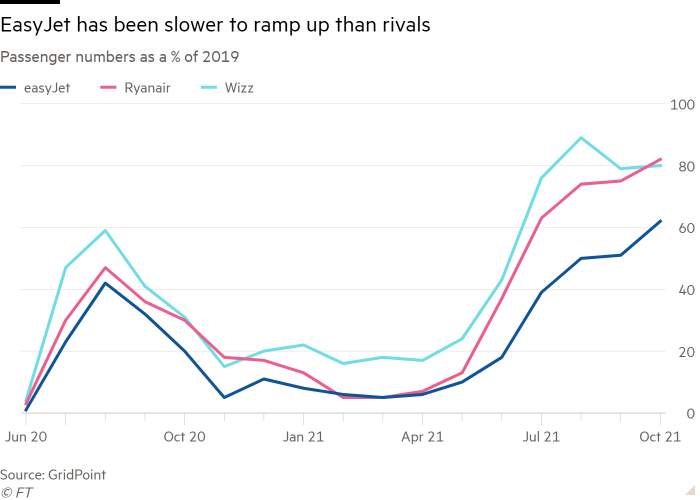

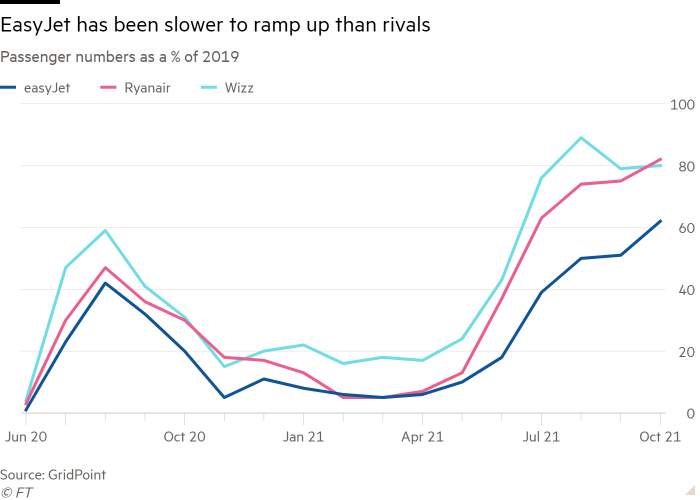

EasyJet’s share price languishes 50 per cent below pre-pandemic levels, in contrast to the recovery of those of Ryanair and Wizz, which have ordered hundreds of jets to take advantage of the retreat of weaker groups as they aim for rapid expansion.

O’Leary has talked of a once-in-a-generation chance to grab market share because of the pandemic, while Wizz launched an opportunistic bid for easyJet, which was rejected unanimously by the British group’s board.

However, some of Lundgren’s caution remains. “The lack of clarity of where we are, and the uncertainty, which has been proven this week [with the emergence of the Omicron variant] as an example, means that you also have to be realistic and understand that this is not a short-term sprint.”

His approach is based on a tough past year for the airline, which lost more than £2bn during the pandemic as it slowly rebuilt its flight schedules and focused on running routes where it could fill seats to maximise returns.

But its depressed share price and capacity, expected to be 65 per cent of normal this quarter, compared with Ryanair and Wizz, which are both back to near pre-pandemic schedules, have prompted some to question whether Lundgren has charted the right course.

One industry executive with knowledge of easyJet’s negotiations with airports said he had been struck by the airline’s caution in adding new routes and jumping on post-pandemic opportunities.

Eddie Wilson, Ryanair’s senior executive, said easyJet “seems to be gradually retreating”.

“They are getting smaller . . . we always take opportunities in periods like this,” he said at an industry event.

Indeed, Lundgren admitted that shareholders felt that targets set out at the company’s annual results presentation in September were not bold enough.

“There’s no secret that there might be some people who are underwhelmed by the targets,” he said of goals that included getting back to pre-pandemic capacity by 2023 and aims for low- to mid-teen return of capital over the same timeframe.

“There’s still uncertainty about the pace of the recovery. Therefore, you want to make sure also that you’re coming out with a target that you feel that you can hit. And you know, my ambition is, of course, to beat them. And that’s the whole purpose of everything that we’re doing,” he added.

However, there are reasons for his more cautious approach compared with his two main rivals. The carrier has suffered because of its exposure to the UK market, which has been slower to recover than continental Europe because of more onerous travel restrictions, including expensive testing.

It also flies from more expensive airports than Ryanair and Wizz and has higher costs.

In addition, Lundgren has faced withering criticism from the company’s largest shareholder and founder Stelios Haji-Ioannou, who wants the airline to slash its fleet, and last year launched an unsuccessful bid to replace the chief executive and other board members.

Although the influence of Haji-Ioannou’s stake has been drastically reduced after his shares were diluted to 15 per cent from 25 per cent when the airline raised capital in September, the pressure to shrink the business has complicated the carrier’s challenges.

“I just note that there was some criticism on the company for 14 months of the pandemic, asking . . . why do we have all these planes on order? And now there’s more like, well, do you have enough of them?” he said.

He also faced the threat of takeover from rivals, highlighted this autumn when Wizz made its bid for the carrier.

“It’s not unusual that these things happen. Equally, we would ourselves look at other companies from time to time,” he said.

But he dismisses significant consolidation as the industry emerges from the pandemic and expects the airline to continue its recovery. Bookings for the summer are now running ahead of pre-pandemic levels, while the accumulation of airport slots means the carrier is well-placed to grab market share.

He also has the early support of new chair Stephen Hester, a City veteran who took up his position on Wednesday.

The carrier “will be straining every sinew to create real shareholder bounceback in coming years”, Hester said on his first day as he stressed the airline’s renewed determination to emerge as a pandemic winner and finally reward its long-suffering shareholders.

Credit: Source link